Labor Market Cracks, Market Anticipates The Fed Holding Interest Rates

Labor Market Cracks, Market Anticipates The Fed Holding Interest Rates

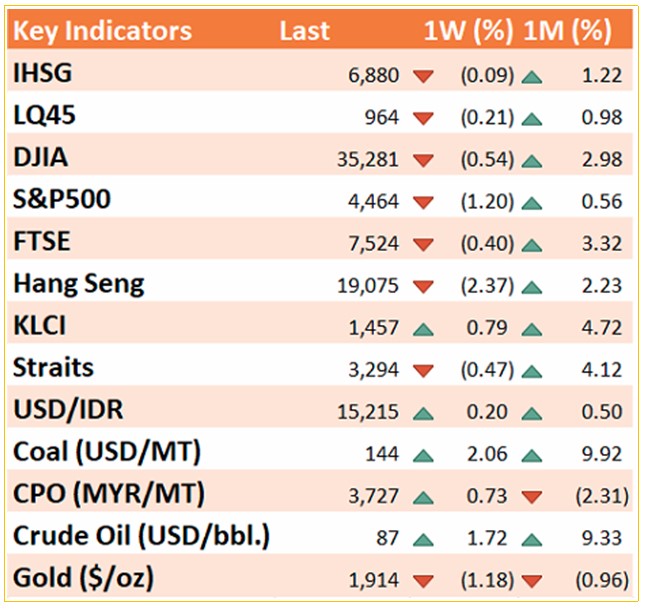

The United States stock market, the S&P 500, closed up 2.5% throughout last week's trading. Positive sentiment originates of economic data about the labor market will be instrumental in shaping The monetary policy decisions Feds. The Job Openings and Labor Turnover Survey (JOLTS) in July showed job vacancies fell below 9 million for the first time since March 2021. Meanwhile the nonfarm payrolls report showed an increase unemployment rate. These indicators point to an economic slowdown, reinforcing hopes that this will be enough for banks central to maintaining stable interest rates. According to the CME FedWatch Tool, market players project that The The Fed will keep interest rates on hold at its next meeting this month, with a 93% probability.

Money Supply (M2) Grows 6.4% in July

Indonesia's money supply, often referred to as M2, experienced a small increase in July 2023 to 6.4%, up compared to the previous month at 6.1%. This increase was mainly due to an increase in net foreign assets (NFA) grew by 9%, compared to 3% growth in the previous month. The increase in NFA was caused by foreign investment net of $0.6 billion in bonds, and $0.2 billion in stock markets. Nonetheless, improvements to this NFA are possible won't last long, as foreign investors withdrew -US$1.7 billion during August. On the other hand, assets net domestic (NDA) slowed to 5.7%, down from the previous month at 7%, mainly due to a decrease in operations central government, as well as a slowdown in regional government spending.

Credit Growth Improves in July

Banking system data for July showed credit growth increasing to 8.5% YoY, faster in comparison previous month at 7.8% YoY. This growth was driven by an increase in working capital credit at 8.1% YoY compared to month previously at 6.5% YoY. For third party funds, total deposits also showed faster growth at 7.2% YoY, compared to the previous month at 6.4% YoY. This increase was driven by the addition of the current account side at 13% YoY, compared to the previous month at 9.5% YoY.

Key Takeaways

The United States stock market S&P 500 closed higher as much as 2.5% during last week's trading. Positive sentiment comes from economic data about the labor market is showing a slowdown economy, reinforcing hopes that this will be enough for the central bank to maintain interest rates stable. According to the CME FedWatch Tool, market participants projects that the Fed will maintain interest rates at meeting next this month, with a probability of 93%.

For the domestic economy, the money supply in Indonesia, often referred to as M2, has increased small in July 2023 to the level of 6.4%, an increase in comparison the previous month at 6.1%. This increase is especially so caused by an increase in net foreign assets (NFA) which grew by 9%, compared to growth 3% in the previous month. This increase in NFA caused by net foreign investment of $0.6 billion in bonds, and $0.2 billion in the stock market.

In other economic news, banking system data July showed strong credit growth increased to 8.5% YoY, faster than month previously at 7.8% YoY. This growth is encouraged by an increase in working capital credit at 8.1% YoY compared to the previous month at 6.5% YoY. For third party funds, total deposit also shows faster growth at 7.2% YoY, compared to the previous month at 6.4% YoY. Ascension This was driven by additions from the checking account side at 13% YoY, compared to the previous month in 9.5% YoY.

ANALYSTS CERTIFICATION

The views expressed in this research report accurately reflect the analysts’ personal views about any and all of the subject securities or issuers; and no part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS

This research is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty nor accept any responsibility or liability as to its accuracy, completeness or correctness. Opinions expressed are subject to change without notice. Contents in this research is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our report and wish to rely upon, whether for the pur-pose of making an investment decision or otherwise. Any recommendations contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is not and should not be construed as an offer or a solicitation of an offer to purchase or subscribe or sell any securities. PT. Surya Timur Alam Raya or its affiliates may seek or will seek investment or other business relationships with entities in this report.