Pasar saham Amerika Serikat S&P 500 ditutup turun sebanyak -1.3% sepanjang perdagangan pekan sebelumnya

Rising Oil Prices and Mixed Economic Data, Fed Will Still Be Hawkish

The United States stock market, the S&P 500, closed down -1.3% throughout last week's trading. Rising oil prices and mixed economic data still raise concerns that the Fed will keep interest rates higher for a longer period of time. The recent surge in oil prices was caused by production cuts lasting longer than expected by major oil producing countries such as Saudi Arabia and Russia. Apart from that, in terms of the US economy, unemployment claims still showed a decline for the fourth week in a row, to 216,000, much lower than market expectations of 234,000. According to market players, the labor market is not weakening fast enough, and that keeps the Fed hawkish. In terms of inflation, according to the President of the Dallas Federal Reserve, Lorie Logan, "the decline in inflation in recent months is a good thing, but lower inflation does not mean inflation is low enough".

August Inflation 3.27% YoY, Lower Than Consensus Expectations

Inflation in August was recorded at 3.27% YoY, lower than consensus expectations of 3.34%. On a monthly basis, inflation in August experienced deflation of -0.02% compared to July. This monthly deflation was caused by prices in the food, beverage and cigarette categories, as well as lower prices in the energy category. This decrease was mainly caused by the price of shallots which fell 24.69% from the previous month, the price of broiler chicken meat which fell -5.1% from the previous month, and the price of chicken eggs which fell -2.87% from the previous month. Even though there is monthly deflation in the food group, rice price inflation is still relatively high at 15% YoY. This is due to the impact of El Nino which is predicted to continue until the first quarter of 2024. BPS predicts rice production will experience a deficit of 0.77 million tons in October 2023.

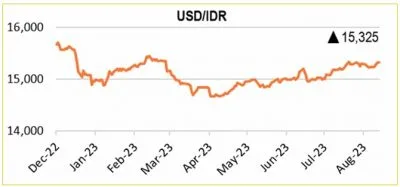

Foreign Exchange Reserves Decreased by USD 580 Million

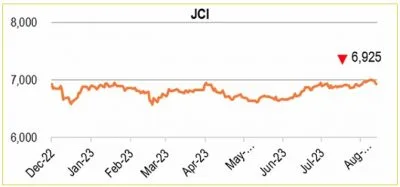

Bank Indonesia reported that foreign exchange reserves in August decreased by USD 580 million, to USD 137.1 billion, or the equivalent of 6 months of imports. This decline reflects BI's active intervention to maintain the stability of the Rupiah exchange rate. BI stated that it would use foreign exchange intervention instead of raising interest rates to support the Rupiah. Apart from that, there was also pressure from foreign capital outflows amounting to USD 1.32 billion from the stock market, as well as USD 0.54 from the bond market.

Key Takeaways

The United States stock market, the S&P 500, closed down -1.3% throughout last week's trading. Rising oil prices and mixed economic data still raise concerns that the Fed will keep interest rates higher for a longer period of time.

For the domestic economy, inflation in August was recorded at 3.27% YoY, lower than consensus expectations of 3.34%. On a monthly basis, inflation in August experienced deflation of -0.02% compared to July. This monthly deflation was caused by prices in the food, beverage and cigarette categories, as well as lower prices in the energy category. Even though there is monthly deflation in the food group, rice price inflation is still relatively high at 15% YoY. This is due to the impact of El Nino which is predicted to continue until the first quarter of 2024. BPS predicts that rice production will experience a deficit of 0.77 million tons in October 2023.

In other economic news, Bank Indonesia reported that foreign exchange reserves in August decreased by USD 580 million, to USD 137.1 billion, or the equivalent of 6 months of imports. This decline reflects BI's active intervention to maintain the stability of the Rupiah exchange rate. BI stated that it would use foreign exchange intervention instead of raising interest rates to support the Rupiah. Apart from that, there was also pressure from foreign capital outflows amounting to USD 1.32 billion from the stock market, as well as USD 0.54 from the bond market.

ANALYSTS CERTIFICATION

The views expressed in this research report accurately reflect the analysts’ personal views about any and all of the subject securities or issuers; and no part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS

This research is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty nor accept any responsibility or liability as to its accuracy, completeness or correctness. Opinions expressed are subject to change without notice. Contents in this research is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our report and wish to rely upon, whether for the pur-pose of making an investment decision or otherwise. Any recommendations contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is not and should not be construed as an offer or a solicitation of an offer to purchase or subscribe or sell any securities. PT. Surya Timur Alam Raya or its affiliates may seek or will seek investment or other business relationships with entities in this report.