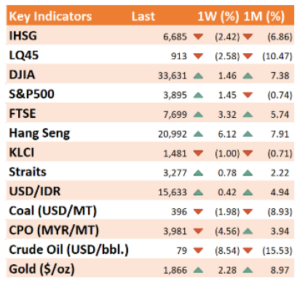

STAR Insight, Market Update 09 January 2023

S&P 500 Closes Up 1.86% on Employment Data

The United States stock market, the S&P 500, closed up 1.86% in the first trading week of 2023. The S&P 500 experienced a significant rally last Friday after the US government released a report on employment data. In this report, the number of jobs in the US increased by 223 thousand, higher than economists' estimates of 200 thousand. Apart from that, the unemployment rate has decreased to 3.5%. Both of these things are actually considered bad, because the Fed needs a weak employment market to relax its monetary policy. However, what is considered positive by market players is the potential for weakening wage growth due to an increase in the number of jobs. All sectors in the S&P 500 closed green in trading last week, with the highest increase in the Energy sector at 3.76%, followed by the Materials sector at 3.56%.

APBN deficit 2.38% of GDP, lower than government target

The 2022 State Revenue and Expenditure Budget (APBN) recorded a deficit of IDR 464.3 trillion or 2.38% of gross domestic product (GDP). This figure is relatively low compared to the government's previous target of 2.5% to 2.8%. The factor influencing the decline in this deficit came from state revenues which exceeded the target, reaching 115.9%. Meanwhile, in terms of expenditure, it is slightly below the target of achieving 99.5%. With this lower deficit, it could encourage the government to be more flexible in issuing fiscal policies this year, including by continuing the various incentives needed for the business world. Apart from that, the government can also accumulate reserve funds to anticipate global economic turmoil in 2023.

2022 inflation will be 5.39% YoY

The December 2022 inflation report closed the year with an increase of 0.66% month-on-month or 5.51% year-on-year. This inflation figure is higher than the consensus of 5.39%. This increase was driven by the year-end holiday period which pushed up food and transportation prices. Food prices were recorded to have increased by 2.2% compared to last month, due to increases in the prices of rice, red chilies and eggs. Meanwhile, the increase in transportation prices was driven by high demand for plane tickets.

Key Takeaways:

The United States stock market index S&P 500 closed up 1.86% in trading last week after the release of employment data which showed positive indications for the Fed's sentiment. The rising unemployment rate and increasing number of jobs are positive indicators for market players because they indicate weakening wage growth, which is what the Fed wants before the monetary relaxation policy can be implemented.

For the domestic economy, Indonesia recorded a APBN deficit of 2.38% of GDP, lower than the government's target of 2.5-2.8%. This comes from state income which exceeded the target by 115.9%, and state expenditure which was slightly below the target of 99.5%. For inflation data, December 2022 closed with an increase in inflation of 5.39% YoY, driven by the year-end holiday period which pushed up food and transportation prices.

ANALYSTS CERTIFICATION

The views expressed in this research report accurately reflect the analysts’ personal views about any and all of the subject securities or issuers; and no part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS

This research is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty nor accept any responsibility or liability as to its accuracy, completeness or correctness. Opinions expressed are subject to change without notice. This document is prepared for general circulation. Any recommendations contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is not and should not be construed as an offer or a solicitation of an offer to purchase or subscribe or sell any securities. PT. Surya Timur Alam Raya or its affiliates may seek or will seek investment or other business relationships with entities in this report.